Nothing feels better than a well-deserved reward. That’s why we make it easy for customers to thank your staff on pick-up orders. 100% of any tip given will go into your weekly payout for distribution to your employees. In this article, you’ll find everything else you need to know about staff tips on DoorDash.

What are the benefits of turning on staff tips?

Staff tips are a powerful way to motivate your staff by boosting their earnings and giving customers a way to say “thanks”. By turning on tips, you could boost your overall revenue and provide a means for your customers to reward your staff for their service. You can choose what store(s) you’d like to offer tips. Learn more about How do I turn on staff tips for DoorDash Pickup?

Can I collect tips for in-house staff for pickup orders with my point-of-sale (POS) integration?

Whether or not you can allow customers to give your in-house staff tips on pickup orders through your POS integration, will vary depending on which POS system you are using. Learn more about your POS provider by reviewing Our Integration Partners notable features. You can contact DoorDash Support if you have additional questions.

How do I turn on staff tips for DoorDash Pickup?

Check out How do I turn on staff tips for DoorDash Pickup? for step-by-step instructions.

How are staff tips paid out?

Staff tips are included in your weekly payout as a lump sum. It will be your responsibility to distribute those tips to your staff. Failure to distribute tips can constitute wage theft in certain municipalities.

Where do I see the amount of staff tips collected?

To see the amount of tips collected check out your Monthly statement for the lump sum amount or for a detailed order breakdown download your Transactions breakdown report available in report builder.

To learn more check out our How to Understand Your DoorDash Payout and Monthly Statement?

Alternatively for orders within the last 90 days you can see the amount of staff tips collected in a few locations:

Orders Tab: If you click on Order History, you can click on each order and see tips for individual orders.

Financials tab: Here you’ll see them in your payout summary.

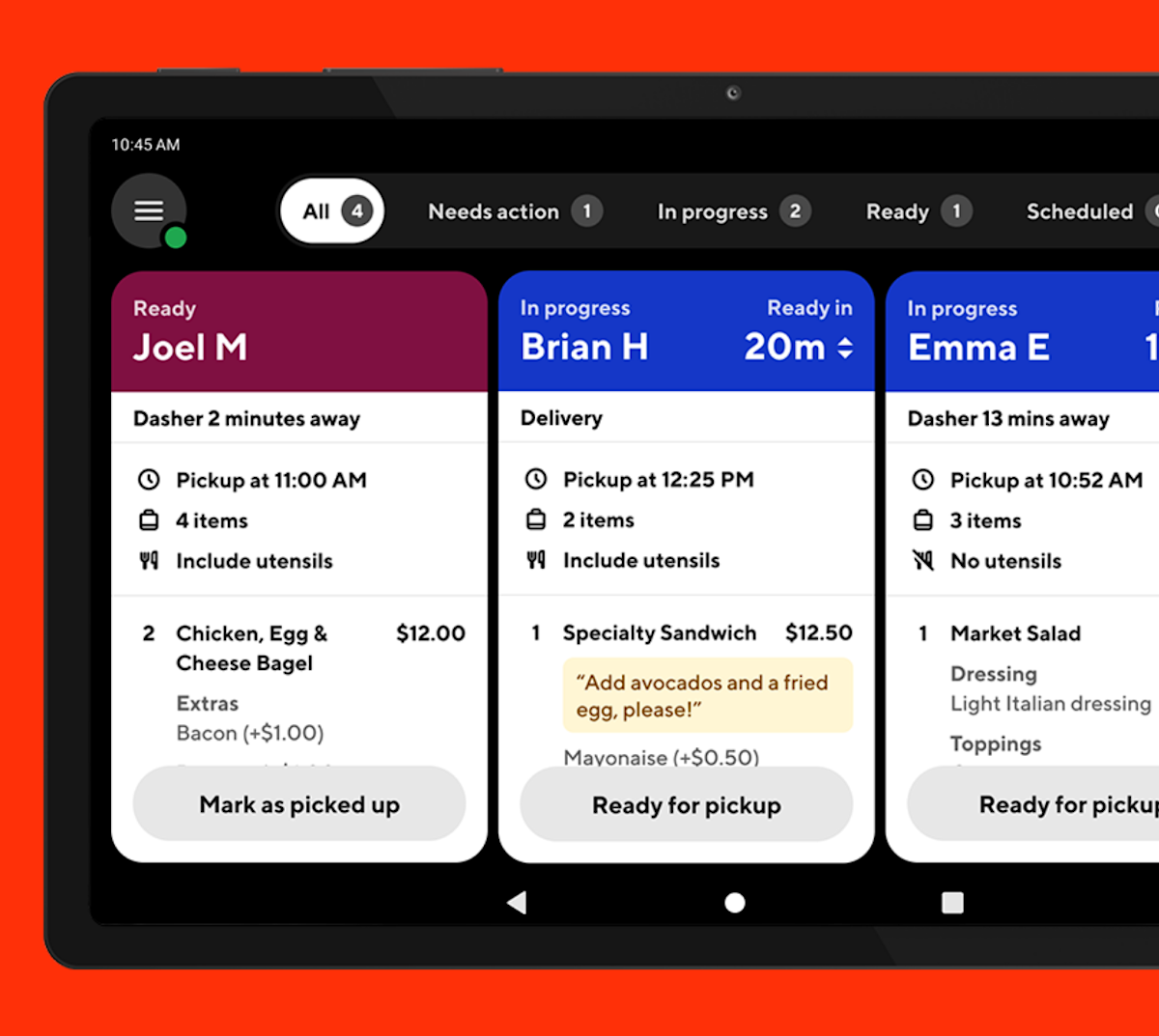

DoorDash Tablet: Your staff can view individual tip amounts for each order.

Weekly summary payout email: Your weekly email sharing your payouts will also include staff tip information.

What employees should I give tips to?

Laws defining tipped employees can vary and compliance with federal, state, provincial or local laws on this topic can depend on your specific business. Please consult a legal or tax professional if you have any questions or concerns about how to comply with the applicable laws and distribute staff tips.

How should I reconcile my staff tips?

Consult with your tax advisor and bookkeeper on various ways to distribute staff tips. Whether you pool tips per shift or distribute tips to individual employees, it’s easy to download the order by order breakdown across your operating hours to reconcile tips in DoorDash’s Merchant Portal or through the transactions breakdown available in report builder. To learn how, check out How to Understand Your DoorDash Payout and Monthly Statement with more on how to view your tips.

Incorporating staff tips into DoorDash pickup orders is a simple yet impactful way for customers to show appreciation. This feature enhances staff satisfaction, fostering a positive work environment and recognizing your team's hard work.

If you want to learn more ways to support your team, check out How to Quickly Train Your Team to Use DoorDash.

When is the new ‘No Tax on Tips’ effective in the US?

As a part of the One Big Beautiful Bill Act (“OBBBA”), the “no tax on tips” is effective for 2025 through 2028. DoorDash is continuing to monitor the reporting requirements mandated by the IRS and will provide an update as soon as one is available. In the meantime, you can view tips in your monthly statements or through financial reports in the merchant portal.

The IRS announced on 8/7/2025 that the tax forms 1099-K will remain unchanged for the tax year 2025, meaning that tips will not be a reportable field on the forms 1099 until 2026 tax season.