What are the new changes regarding Canadian tax reporting and how does this affect me as a merchant?

Canada implemented Bill C-47, the Budget Implementation Act, 2023, No. 1, which includes new tax reporting rules for certain digital platform operators like DoorDash. Under these rules, Doordash must collect specific merchant information and report it to the Canada Revenue Agency (CRA) each January for the previous calendar year. These reporting requirements apply only to merchants who earned more than CA$2,800 in sales on the DoorDash platform during the prior calendar year.

What information is DoorDash required to include in its report to the CRA?

DoorDash must include the following merchant information in its annual report:

Business legal name

Business primary address

Business tax identification number

Total earnings paid or credited during each quarter of the prior calendar year

Total number of deliveries from your business during each quarter of the prior calendar year

Total fees and taxes withheld or charged by DoorDash during each quarter of the prior calendar year

Will I receive a copy of the information reported to the CRA?

Yes. DoorDash will provide each merchant with a personalized annual report in the Merchant Portal by January 31, starting in 2025.

This report will reflect the information shared with the CRA and is only available to merchants with more than CA$2,800 in sales during the prior calendar year.

DoorDash is sending me messages saying my tax identification number is missing. What does this mean?

Canadian law requires DoorDash to collect and report each merchant’s legal name, primary address, and tax identification number to the CRA. If you received this message, our records indicate that we have not yet received your tax identification number. A missing or incorrect tax identification number could result in fines of up to $500 per taxpayer or legal entity, as enforced by the CRA. Additional penalties may apply if this information is not provided promptly.

If needed, you can update your tax information on the Merchant Portal:

Log in to the Merchant Portal.

Select Settings on the left-side panel.

Select Bank Account.

Select Edit next to Business details.

Enter GST/HST Number and select Save.

If you're still seeing “Incomplete” next to the Business Details section, the legal business name, the GST/HST number, or both may be incorrect.

If you’ve confirmed the information is correct but the Merchant Portal still won’t verify the information, you can upload documentation in the ‘Verify Business’ section by clicking ‘Edit’ next to ‘Business details’. A list of acceptable documents is available in that section.

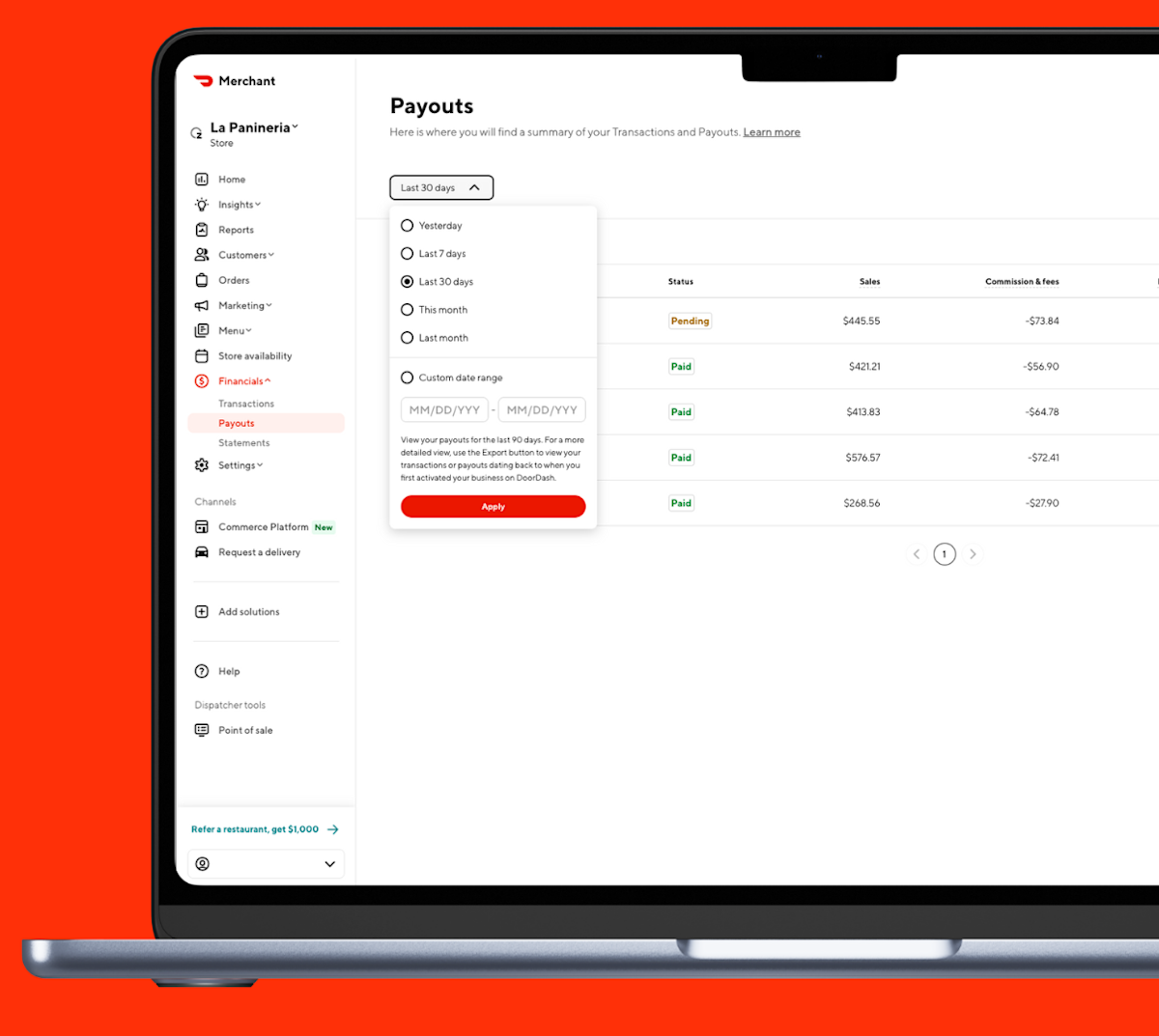

How can I view this report?

Beginning on January 31, to view, save, export, or print your PDF report, please follow the steps below:

Log in to the Merchant Portal.

Select Financials on the left-side panel, then select Statements.

Select Tax forms.

Available tax forms will be listed on the page. Select from available actions to open or download a form.

I don’t currently see any reports in the Merchant Portal. Why is that?

The report will be available by January 31, 2025. If you had CA$2,800 or less in sales on the DoorDash platform in the prior calendar year, no report will be available.